Central Banks loss of control: The markets of manipulation and their collective activism.

As the Federal Reserve begins to lose control of its own

interventions into capital markets, with over 7 Trillion dollars already down

as asset purchases that line its balance sheet, the en masse of monies to

counter any deflation that may have occurred via COVID-19 freezing bond markets

in March 2020 and the terrible decision to buy Junk Bonds and Exchange-Traded

Funds (ETFs) has created the speculation buy from hell. And it is not just greedy Wall Street, but so

called Main Street, the general populous have joined the chorus of an all in

bet, noted with the fiasco with the unprofitable and junk rated company

GameStop, egged on by the bizarro 'libertarian' and soon-to-be trillionare on

Twitter as a campaign against Hedge Funds.

With the vaccinations and successful lockdowns in reducing deaths and

infections which in turn relieved the stressed hospital system throughout

Europe and America, the stock market has been, albeit deceptive, the oracle of

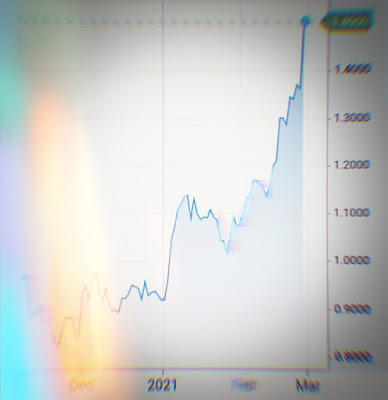

a future all clear, except one of the marvels of free-markets and its future indicators are the yield curves

(interest rates) on bonds, which are now rising. In fact they are now rising faster than anticipated. The interest rate spikes are

indicative of speculative markets like stocks and real estate, to which money

is pouring out of safe havens, such as bonds, gold and moving into a greed trade that includes

Cryptocurrecies, which offer no interest rate return whatsoever. Due primary to the excessive amount of

liquidity in the system, which is almost entirely responsible by Central Bank's

asset purchasing and quantitative easing programs (printing money) all in the

shadow, although it has not completely passed, of COVID-19.

As discussed in Markets of debt and the Food Inflationshock, in March 2020, adjusted for inflation the 10 year Treasury note dipped

below 1%, borrowing costs, for that brief moment, were now in favor of the

borrower, to the extend what one would payback would be less than what is being

lent, with the lender making little or no money off yields and essentially

lending at a loss. The UK, Japanese and

European Central Banks are now offering negative interest rates on bonds,

namely the 30yr, since they, the central banks support the yield curve,

monitoring its fluctuates – they have stepped over the line in trying to

control and manipulate rates to become negative, which has driven billions of

dollars out of bonds into risker assets and their higher yielding dividends of

stocks. But, despite these efforts in trying to suppress the rates of bonds, particularly

US Treasuries, the outpouring of capital into stocks has forced these surging

bonds rates, more so the 10 year to spike, closing at 1.58% February 25th 2021,

which panicked stock markets such as the so called growth sector, with a

promose pf profits at some point in the future, these technological stocks were

substantially sold off.

The issue that will be begin to ring true, despite a mandate of a Central Bank that

believes that they can ward of higher unemployment by allowing the stock market

to surge in all its mania, there is also feverish speculation of retail

investors using mobile apps via stimulus cheques. According to a Deutsche Bank analysis on the

$465 billion about to be delivered to American households, they estimate that

$170 Billion will flow into equities to bet on small unprofitable companies

split between investors who will buy long term and the others via Twitter and

Reddit that are on a strange crusade, although it is still lined with greed, to

squeeze billion dollar hedge funds out of short selling positions.

Under all this is of course inflation, higher costs to

build inventories, pay staff and to pay

down insurance which is always at a premium.

The other factor is profits, that have all been crimped by the pandemic,

now with the Northern Hemisphere about to reopen from its lockdowns , don't

expect fire sales and cheap prices.

Rather costs of products will be substantially higher to cover the lack

of profits from a shutdown 2020. So, in

a simple way of looking at these markets that move from speculative driven

greed into safe havens to protect money, which are bonds and this rapid rise in

bond yields could be indicative that something major is lingering in all this

intervention, manipulation and market distortions. And it may not just be inflation on foods

and bills, but something more

dramatic.

Comments

Post a Comment