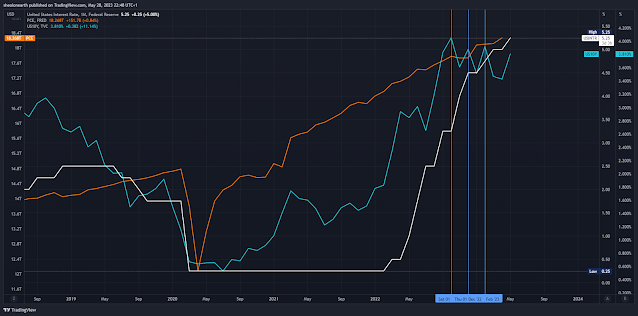

U.S. PCE RISES IN APRIL to 4.8%. RATES SHOULD BE ABOVE 6% BY NOW. THE 10 YR YIELD IS TELLING OF THE INDICIVENESS OF THE Federal Reserve.

The Federal Reserve is still behind the curve with inflation, with the U.S. Personal Consumption Expenditure index for April 2023 rose to 4.8% from 4.6%, which was mainly on consumer spending, thus showing how imbedded inflation has become for the American economy. Prices are going upwards, when interest rates ala the U.S. Dollar which, via consumer sending power, should have brought down inflation. The Fed's rate at its current 5.25%, in all definition should be by now at 6%. Note with the Chart above the 10 YR yield (light blue line) from October 2022 to February 2023 is floating between 3.8% and 4.0%, as a basic indicator of how indecisive the U.S central bank has become in lifting rates beyond 5%.

Comments

Post a Comment