Posts

Showing posts matching the search for 10 YR yield

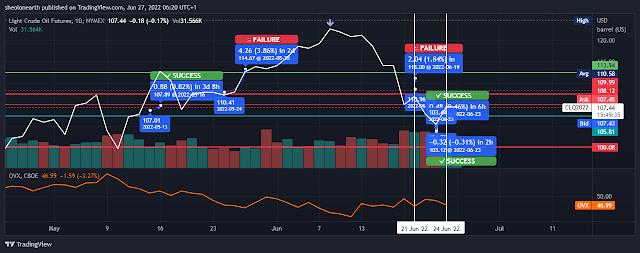

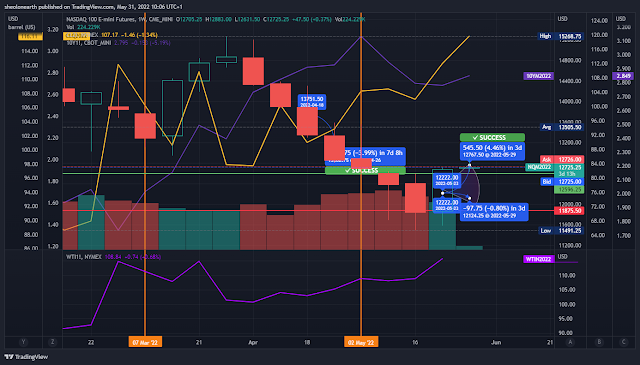

NASDAQ March/April/May 2022 bear market and its correlation with the oil price/10 YR yield.

- Get link

- X

- Other Apps

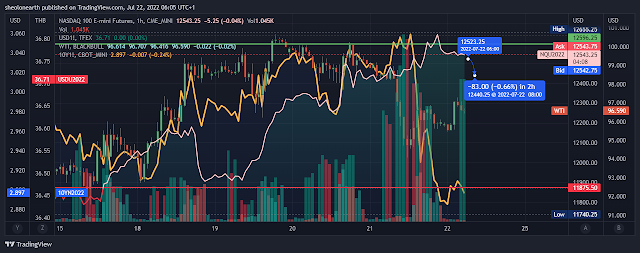

Bank of Japan for the first time in seven years opens up the 10 YR yield, taking interest rates out of negative territory. The YEN and stocks rally so does the oil price. Full blown stagflation was held at bay in 2022 on massive oil market interventions. Can it be achieved in 2023?

- Get link

- X

- Other Apps

The 10 YR BOND (U.S.) and 10 YR GILT (U.K.) reach 16 year highs. U.K. financial crisis is heating up dragging U.S. yields.

- Get link

- X

- Other Apps

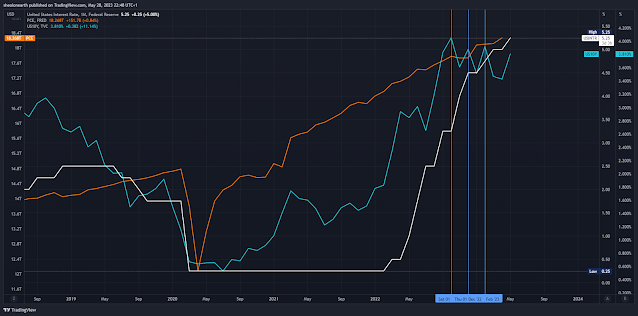

self explanatory chart: Declining inflation in 2024? the 10 yr yield futures thinks otherwise. Sitting at a Three month high of 4.60%. Can Trump's war on everyone, climate change and general economic chaos push the 10 yr to 5%? 2025 awaits.

- Get link

- X

- Other Apps

S&P 500 IS NOW rallying above its 3692 support, earnings for banks have been solid as the tech sector is up next. All eyes on the NASDAQ and 10 YR yield. Geopolitical: Ukraine.

- Get link

- X

- Other Apps

Bank of England throws in the towel, rather than triggering interest rates, buys long dated gilts, prints money to mess with the short end of the bond market. Stocks and bonds all go bid, alongside the oil price. Total backfire. Central Bank lesson of how 'yield control' with inflation is dangerous.

- Get link

- X

- Other Apps

Fitch downgrade of U.S. debt strips off their AAA rating, now AA+. Growth/Spec stocks sell off, 2% 10 YR Yield and USD rally. The 10 YR yield is now at 4% before the SVB bailout. U.S. oil stocks are at the lowest in history, will eventually show up in the oil price.

- Get link

- X

- Other Apps

Oil price swing trade is on and off. Caught the sell and rally, on 'confusion' of a slowdown or stagflation recession. Central Bank rhetoric has smoothed out volatility. But for how long? China is about to snap back consumption en masse after COvid lockdowns. Russia will maintain the Ukraine war. Check your grocery bills

- Get link

- X

- Other Apps

End year Inflation expectations are rising in tandem with the 10 YR yield, which is shy away from 5%. Central banks will most likely deliver rate increase/s year end (update 1)

- Get link

- X

- Other Apps

Stocks are bouncing off 10 YR yields falling, after safe haven inflows. HFTs bidding a little too hard as a precursor that risk has been priced in. It hasn't. Oil is still trading above $69 and below $97, average price at $85. MArkets are on hope that the bond market will be supported in another full blown crisis. Problem: we do not have deflation.

- Get link

- X

- Other Apps

The 10 YR yield is pointing towards interest rate hikes, not cuts. Will it reach 5%?

- Get link

- X

- Other Apps

Australian dollar collapses on Chinese inflation figures. Chinese 10YR Bond yield is falling beneath the U.S. 10YR, this has only happened three times in 12 years. Chinese labor and electricity costs are surging. COVID-19 2nd beatdown is sending China into widespread stagflation.

- Get link

- X

- Other Apps

Bond distortions showing up after the Silicon Valley Bank collapse. No bailout. Market is scrambling for safe havens: U.S. Bonds and Gold. VIX is pointing towards extreme volatility if bond holders later dump 'bonds' before the Fed's 22nd March meeting.

- Get link

- X

- Other Apps

Reflation trade is spluttering out. Tech sector is bid on price increases, Chip shortage maybe ending till the next Taiwan drought. 10 YR collapsed on the back of the ECB rate increase. OIL and USD are slightly bid. stocks appeared topped out.

- Get link

- X

- Other Apps

End week chart/s. 'Stagflation lite' or just an almighty mess brewing?

- Get link

- X

- Other Apps

U.S. PCE RISES IN APRIL to 4.8%. RATES SHOULD BE ABOVE 6% BY NOW. THE 10 YR YIELD IS TELLING OF THE INDICIVENESS OF THE Federal Reserve.

- Get link

- X

- Other Apps

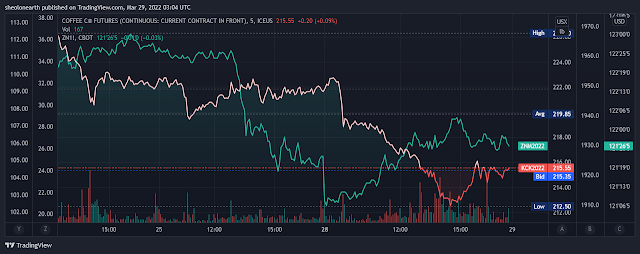

The correlation of Coffee prices and the U.S 10 Year Treasury note.

- Get link

- X

- Other Apps