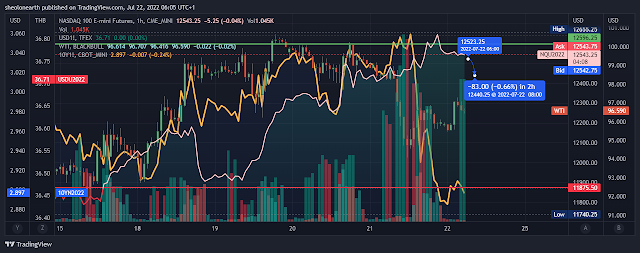

Reflation trade is spluttering out. Tech sector is bid on price increases, Chip shortage maybe ending till the next Taiwan drought. 10 YR collapsed on the back of the ECB rate increase. OIL and USD are slightly bid. stocks appeared topped out.

(Chart 1)

The reflation trade remains slightly intact, until it isn't. With the NASDAQ trying to settle above its 12600 support via somewhat solid earners from tech companies (chip shortages easing (?) and price increases), with the 10 YR yield collapsing from 3% to 2.80% on the back of the European Central Bank finally lifting the European Union interest rate to 0.50%. After 11 years of probably the most disastrous low/negative interest rate, bond buying program in history, which now with pandemic/s, supply chain issues, climate change. war, oil/energy/food inflation the era of cheap money and excesses has come to a dramatic end. Central Banks have backed themselves into a corner.

Oil and USD ae bid, with the 10 YR finding a floor. The NASDAQ has topped out. Position on. Chart 1 above.

As economist Nouriel Roubini argues, we are heading into a stagflation debt crisis like none other. I agree.

Comments

Post a Comment