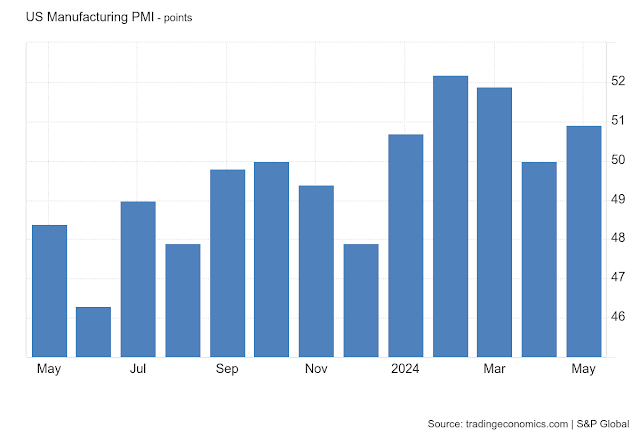

Purchasing Managers Index for May accelates, y/o/y pushing up consumer costs and supplier prices. Once again, pointing towards a stagflation dilemma for the Fed. the Dow sinks 600 points. AI and crypto are a runaway train of speculation, they won't help the economy.

(Chart 1)

As discussed in numerous posts re: NASDAQ and the speculation trade ala The Federal Reserve showing confusion around inflation, which is stuck within the U.S. economy or the onset of Stagflation which could reappear as an issue into 2024. The Purchasing Managers Index is now year-on-year, higher than what it was in May 2023, please refer to Chart 2. The obsession with running high Gross Domestic Product over inflation concerns, thus achieving full employment, that is all the service sector, is bad economics. But, one that has been in place for over Two decades, and now reckoning is here and embedding itself in the form of inflation and stagnation. The Fed are a little late on the trigger, and rates should be higher than 5.25%, 7% is probably realistic in taming inflation, which would probably send America into a recession. Either way, stagflation would be disastrous if left unchecked, with the oil price bid over $78, the days of $50 per barrel of oil are all but gone, and three major proxy wars going on simultaneously: Middle East, Russia and China. Wars are inflationary. Military spending is the highest since the First Cold War.

The other issue, is the Fed not reigning in speculation, which they seem to be doing the opposite. Crypto and AI are not economic wonders. AI as a tangible and assisting element for humanity, is over a decade away (I have done an AI course). What we are using today is called "Weak" AI, "General" is still science fiction. Crypto and Bitcoin, is mega fund manager BlackRock's new Exchange Traded Fund products, which lifting the assetless-asset into a perpetual trading range above 60K. And crypto overall is a carbon emitting nightmare, and possibly a contributor to energy inflation. Rates, should knock this thing flat.

Chart 1, is the NASDAQ with call out notes.

Supports (red horizontal lines) are at 18684, 17878. A drop below 17180 (April 2024) cannot be ruled out.

Comments

Post a Comment