Posts

Showing posts matching the search for stagflation

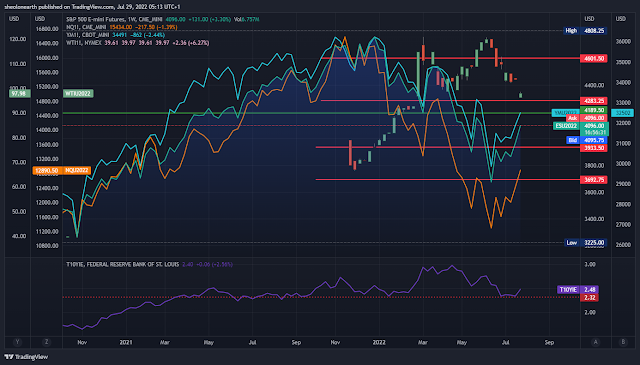

The Fed jawbones market, saying that a stagflation recession in America won't happen. Markets rally but appear to be falling into a 'bear trap' . U.S. Dollar is still bid, while oil is heading back to $110. And is there a new pandemic on the way?

- Get link

- X

- Other Apps

Oil futures are trading above $83 per barrel on Israel's looming invasion of Lebanon. If the oil price sits above $90 for an extended period of time, more than a month. Stagflation will be locked into the global economy. A wider conflict in the middle east would be Iran and the U.S. directly in combat

- Get link

- X

- Other Apps

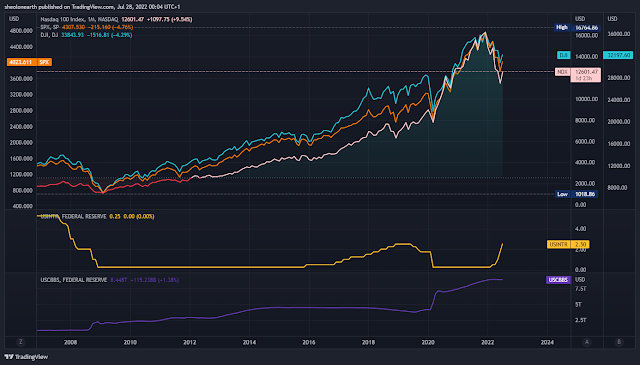

All major U.S. indexes are now in bear territory, oil rises on supply chain and capacity issues. The market is finally pricing in global stagflation. The U.K. crisis could turn into a contagion if U.K assets are dumped en masse, while the English government tries to spend to offset stagflation. 30 YR gilt is through the roof.

- Get link

- X

- Other Apps

China won't tighten its economic policy on looming stagflation . Chinese 10 YR yields have dropped, while Copper and Oil are bid, showing that inflation and a slowing economy are simultaneously occurring. China hyperinflation and on a war footing re: Taiwan?

- Get link

- X

- Other Apps

All major indices are now trying to rally above the S&P 500 supports after the Fed threw in the towel. Tech sector is benign, with cyclical stocks bid. Overall the Market is showing signs of confusion re: Central Banks lack of clarity on inflation. Oil is bid, while the recession and inflation fears remain, mixed with tightening supplies. We all could be at the cusp of a huge stagflation storm and it has just begun.

- Get link

- X

- Other Apps

The yield curve has inverted. Markets are pricing in a recession, but not stagflation. Are Central Banks reluctant to increase rates aggressively in an effort to stabilizing stock markets? Volatility could hit hard. Eyes on, oil, NATO and Putin.

- Get link

- X

- Other Apps

No recession going into 2023. Australia's bell weather economy is stuck in persistent inflation, returning in the last quarter of 2022. Now at 7.30% from 6.1%. All eyes on China's 'covid' supply chain shock and the U.S. inflation reprieve of lower fuel costs spluttering out

- Get link

- X

- Other Apps

Volatility, confusion and Chaos. Is inflation being mispriced on China deflation blips? With inflation gauges showing up as volatile, energy and Wheat/food prices are all heading back up again. Inflation and stagflation maybe becoming entrenched.

- Get link

- X

- Other Apps

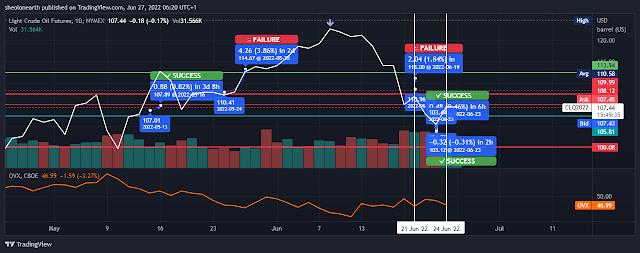

Oil price swing trade is on and off. Caught the sell and rally, on 'confusion' of a slowdown or stagflation recession. Central Bank rhetoric has smoothed out volatility. But for how long? China is about to snap back consumption en masse after COvid lockdowns. Russia will maintain the Ukraine war. Check your grocery bills

- Get link

- X

- Other Apps

Do you want a $8.55 (U.S.) cup of coffee with your stagflation/Trump trade war with everyone economic chaos? Can't really just blame Trump's tariff madness (although a factor), climate change has everything to do with COffee prices going upward. A precursor to food prices. Shame, Central Banks are still calling deflation as a threat. Who will blow out the global economy first? (part 7)

- Get link

- X

- Other Apps

Purchasing Managers Index for May accelates, y/o/y pushing up consumer costs and supplier prices. Once again, pointing towards a stagflation dilemma for the Fed. the Dow sinks 600 points. AI and crypto are a runaway train of speculation, they won't help the economy.

- Get link

- X

- Other Apps

Federal Reserve backtracks on rates, as expected, market rallies. Oil now parabolic. War trade is on and so is inflation. Stagflation will rule the day.

- Get link

- X

- Other Apps

Oil holds above $110 as reserves in the U.S. begin to decline despite a stagflation recession looming. 3 day forecast/trade to $112. A prelude to winter energy crisis about to hit Europe, as Putin, by default, sanctions the whole of Western Europe as economic warfare. Germany begins firing up coal power stantions. It's Climate Change and an Economic ice age on the horizon.

- Get link

- X

- Other Apps

.png)