All major indices are now trying to rally above the S&P 500 supports after the Fed threw in the towel. Tech sector is benign, with cyclical stocks bid. Overall the Market is showing signs of confusion re: Central Banks lack of clarity on inflation. Oil is bid, while the recession and inflation fears remain, mixed with tightening supplies. We all could be at the cusp of a huge stagflation storm and it has just begun.

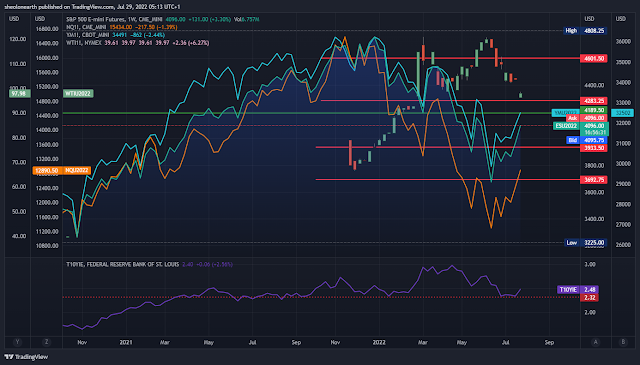

(Chart 1)

The Federal Reserve's throw-in-the-towel and half-assed 'put' is in play as a overbought reflation trade, As the market is pricing in, incorrectly, gradual rate increases by the Fed, with Bank of America even calling for rate cuts in late 2023! Yet, the primer in all this recession/inflation/stagflation confusion are Central Banks are throwing mixed messages into the market. The fact is, we have terrible inflation breaking out everywhere, mainly lead by energy costs, which have spilled over into everything else. Q3 earnings, particularly the tech sector has been poor, considering that inflation is eating up bottom lines and the chip shortage is not abating anytime soon. You would expect Amazon to weather the earlier aspects of the stagflation storm, mainly because they hold the monopoly on distribution and its sheer size as a online retailer. But their CEO had said after their earnings report that its behemoth workforce would have to downsize at some point. Amazon have ridden the 2020 COVID-19 stimulus pump.

So, Chart 1 above is the S&P 500, NASDAQ and DOW futures, using the S&P 500 supports and resistance lines, all the main indices have bounced off the 3700 (The Fed 'Put'?) and tentatively holding above the 3930, interestingly or maybe not, growth stocks (NASDAQ) are lagging behind the cyclical stocks (DOW and S&P 500), which does point to a slowdown in speculation and risk i.e recession and interest rates. However, the oil price is still elevated above the S&P resistance of 4200 which should crimp any cyclical stocks trying to break out. And finally the 10-yr breakeven inflation rate (below pane) has climbed above it's July low of 2.34% to 2.48%, trailing oil prices that are bid again on tightening oil markets.

Comments

Post a Comment