The Federal Reserve throws in the towel, triggers an expected rate 0.75% and downplays everything. Including a recession and stagflation, sends the USD down, oil rallies. Inflation back on.

Chart 1

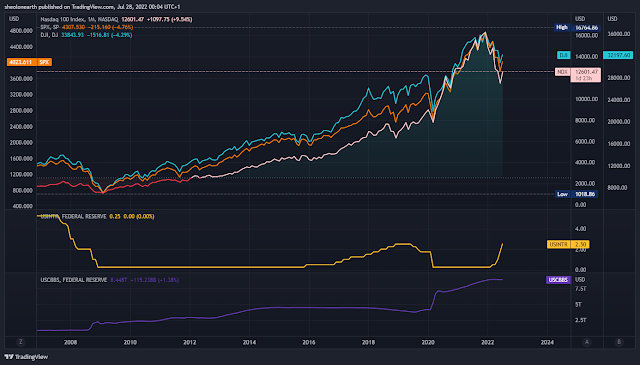

The Federal Reserve has essentially thrown in the towel in its inflation fight. The market consensus, which I agree, was always going to be 0.75% rate hike, to combat imbedded inflation in the American economy. A 1% would have been wiser to show a commitment and retain credibility as a Central Bank to stabilize prices, not speculation, they have done the opposite, more alarmingly Fed chairman Jerome Powell with his speech after the 75 basis point hike, was a flip flop of denial and acceptance of inflation, mixing words like "softening" of the labor market to "Households are in very strong shape" and "That's not to say, lower income households are not suffering." But, the market priced in a reflation rally as soon as Powell said this, "TIME TO GO TO A MEETING BY MEETING BASIS, NOT PROVIDE CLEAR GUIDE AS BEFORE". Which, in not so many words, means that they have either don't want to deal with inflation and/or hope that somehow it will stabilize with out reducing their balance sheet and lifting rates over 3%, which will probably end up being the worst in American history. Yes, climate change/war/pandemics will contiue to drive prices higher.

Please refer to Chart 1, with indices rallying on the Fed's speculation stability via dovish rhetoric and 2.50% interest rate. Note also the Fed's balance sheet at close to 9 Trillion.

Also, refer to my post:

Comments

Post a Comment