Amidst imbedded inflation. Why is Wall Street and investment banks calling a recession in 2022/2023?

It's becoming a little more clearer, albeit obvious in its simplicity, on why investment banks and commercial banks (and even some Hedge Funds) are calling a recession in 2022 and 2023: Continued cheap funding. Hence the tweaking of analysis reports to which the Fed probably reads and are being influenced by, even through their own stats are showing up widespread and imbedded inflation throughout the U.S. and global economy.

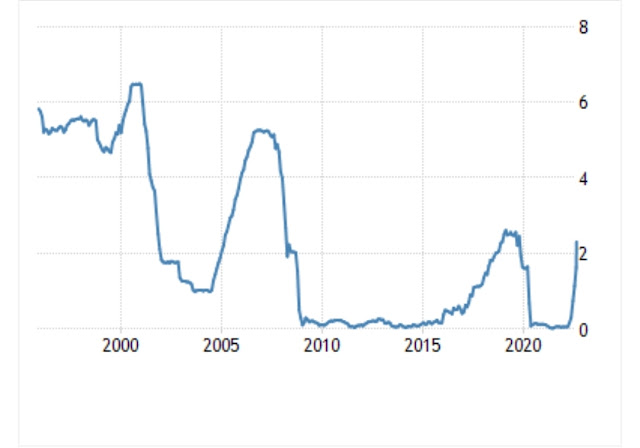

Chart 1. Shows the overnight repo rate at 2.31%, to which banks lend from the Federal Reserve and they (the Fed) swap treasuries (from banks) for cash. Is at historic lows, banks are still pumped full of cash and hiring hasn't slowed down.

Chart 2. U.S. inflation compared with interest rates dating back to 1978. The chart is self explanatory, however, the rate in 1978 was between 5% and 8% while inflation was trending at 9%. Currently in 2022 inflation is at 9.10%, while rates are sitting 2.50%.

We have a stagnated economy, with inflation without high unemployment.

Comments

Post a Comment