Inflation expectations are beginning to rise again in the U.S. after

President Biden prematurely made a claim that inflation was receding, which was only on the back of the Strategic Petroleum Release to being down the price at the pump, explained in these

posts. A temporary manner and a sweetener for the coming Midterm elections, which includes

Biden's debt forgiveness for 12 million + university students, with an overall debt outstanding at $1.6 trillion, will clearly lead to inflation as the extra monies earned that would have gone to paying down debt on now going to used in consumption.

With the taxpayer taking a hit on the government needing to fill the bailout hole. On the other hand, the Federal Reserve Bank holds over $8 trillion of corporate/government assets and debt on their balance sheet, which essentially is a bail out mechanism to

Wall Street and the like, to push liquidity into banks, has billowed out to extraordinary levels. The reduction or roll-off of bonds held on the Fed's balance sheet will end up pushing up long term rates i.e. mortgages. The commercial and investment banks won't take the loss (The Fed will), but we're all going to be paying more interest back on commercial loans. Yes, there is rampant hypocrisy in the land of debt and with markets becoming more and more unstable as the institutional underwriters begin to reassess their polices.

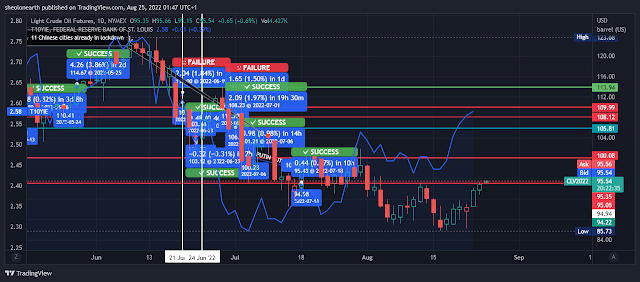

In the meantime, the chart above shows the 10 year-breakeven rate and the oil price that work in correlation of inflation expectations. The oil price has spiked from the 16th August at $87 a barrel to $95 (25/08/2022), dragging up the 10 year-breakeven rate at 2.44% (16/08/2022) to 2.58% which is a two month high (June 2022) when the oil price was at $100 a barrel.

Comments

Post a Comment