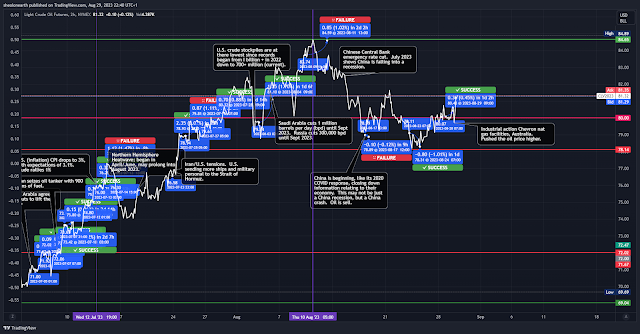

Energy prices spike as Natural gas rallies over 3% as industrial action at Australian gas facilities begins, oil turns bid at $81. SUch is the perils of price controls, particularly on Nat Gas. U.S. crude inventories are still dropping to their historic lows.

Chart 1

Energy prices, despite China's so called slowdown, are beginning to climb again. So called Chinese recession would have dashes of inflation stretched across its markets, with the deflationary basket case Japan now feeling inflation lapping its shores, so it is highly unlikely that China will export deflation, apart from mass unemployment globally. Chart 1 above shows the oil price bouncing of its $78 support, now bid at $81. This is partially due to Natural gas prices (Chart 2) which are now bid at 2.87, breaking out of its Jan 2023 trading range of 2.36 and 2.69. The reason for Nat has jumping over 3% from it Aug 2023 lows. Strike action at the Chevron gas facilities in Australia. Why? Well, since there is global price control on Nat gas, which in turn has artificially suppressed gas prices, has lead to supply/profit shortfalls = crimped wages. Thus industrial actions would follow suit.

*Also note U.S. crude inventories are still dropping, recent API update is at -11.4 million barrels, estimation were for a -3.3 million drop

Comments

Post a Comment