Biden releases one million barrels of oil per month from the Strategic Petroleum Reserve, oil collapses under $100. Central Banks handballing the inflation problem back to Governments. Rates are too low, core inflation is parabolic. Oil investment crash next? Putin will veto Germany's gas supply if they don't pay in Rubles. How far will Russia allow the oil price too drop?

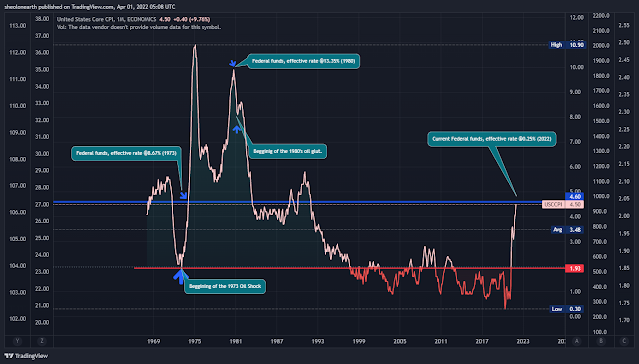

President Biden has ordered the biggest release of oil from the the U.S Strategic Petroleum Reserve (SPR) in history, as discussed in this post, the amount is 180 million barrels, starting in May 2022, releasing a million barrels per month in an effort to bring the oil price down. This is the 3rd time Washington has ordered an emergency release of the SPR, in all of the it hasn't made any significant impact in the oil price, even before the invasion of Ukraine. Which points to the problem of inflation and Central Banks reluctance in not increasing rates in tune to a stagflation economy, as noted with the Chart 1 (above), detailing the rate increases in compared with the U.S. core inflation going back to 1973, the era of stagflation and the 1st oil crisis. We are way behind in containing inflation with interest rates. That ironically in 1974 the SPR was created to leverage the next oil crisis. And Biden just shot off a round, which is a single shot. Get it wrong, say a war breaks out in the Middle East...Well, we'll just see what happens. Meanwhile lawmakers should be pressuring the Fed (U.S Central Bank) to rally the U.S. Dollar which would have a much better effect on the oil price. But, alas, something is amiss in our world of finance.

The oil price sold on the news, yet it has kept slightly bid just below the Putin 'Put' at $100 (Chart 2). What will be interesting to see, is a global response to the drawdown, as in other countries falling suit (Chart 3). Which, is effectively the beginning of price controls on oil, while gas prices may drop at the pump it won't make it less expensive to produce oil, in fact it will become even more expensive if price controls are implemented. As noted in my article: "Inflation and the Finite endgame: Oil investment crash" (May 8, 2021), excerpt:

" The International Energy Agency (IEA) has forecast that oil going into 2021 and gas projects could collapse to over 30% of new projects, with an overall expenditure on oil investment dropping from 483 million in 2019 to 347 million in 2020. Referred to as a “upstream investment”, this production decline in a saturated world of oil due was primarily due the COVID-19 lock downs and the crash in the oil price on the 20th April 2020, which also tore into the profit margins of oil companies wiping out 1.4 trillion in upstream investment."

Meaning that oil investments globally could come to a complete stop, thus by default it could trigger a peak oil scenario: oil is too expensive to produce. And with countries just throwing their reserves at the problem, rather than strengthening their currencies to battle rising fuel/food prices. It may indeed be Putin, who will have the last laugh, if he veto's Germany and the rest of Europe gas/oil supplies, even with emptying the SPRs around the world, we could see oil go back to the $110 ranges once again.

Leaving Russia the only country to be self sufficient in oil supply and demand and it would be prudent to undertsand that a war machine with an endless supply of oil, can carry on for a long time.

Comments

Post a Comment