CPI is not in line with the Personal Consumption Expenditures Price Index (PCE) and rising import prices. Oil is now bid at $88 as it was in Jan 2022. Markets are over stepping expectations that Central Banks are slowing down rate increases.

After the Consumer Price Index print show a substantial fall in inflation, minus food and energy, which could be an indication of the flawed CPI metrics that measure inflation. which has been argued as too rigid in assessing consumer prices, please refer to this post. Markets rallied like no tomorrow, the U.S. Dollar (USD) and the DXY (USD weighted index) collapsed. With monies pouring out of USD positions and a mass amount of short covering, equities and speculation went bid, more so the NASDAQ which is sensitive to rate increases/upward bond yields and USD bids.

Chart 1 shows the 10th November rally when the CPI was released, adding over 230 points. One of the largest one day rises since 2020. Of course the big difference between 2020 and 2022, there is a lot less stimulus floating around and interest rates are over 3% more than what they were when the pandemic was in full swing. Also note the sell off of the USD, which also drove the oil price up, refer blue vertical line (11th Nov2022 ), close to $90 ppb of oil.

Chart 2 showing the price of oil is now back to what it was on 31st Jan 2022 (refer blue vertical line), before markets began pricing in the Russian invasion of Ukraine and post 2019 /2020 supply chain crunches and stimulus hangovers, which lifted food and energy prices across the board.

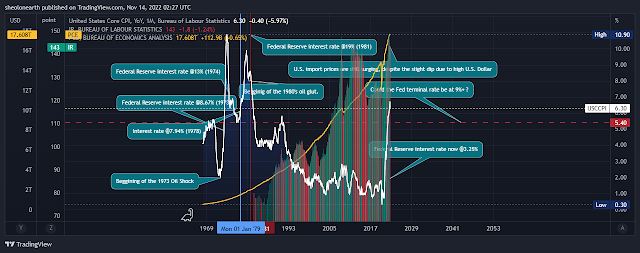

Chart 3. Is the CPI and the Personal Consumption Expenditures Price Index (PCE) with import costs (bar chart), both the CPI and PCE are overly broad in the measure, but at least the PCE is more sensitive towards USD purchases, which in turn tracks import costs quite well. Meaning? That prices for things are going up, not down.

Conclusion. The markets have gone way above expectations that the Federal Reserve and other Central Banks are about to pause or pivot their rates hikes. And all Central Banks are aware, that when the market rallies as hard as it did on the 11/11, the US dollar is sold off and the purchasing power that the Fed is trying to instill in the USD has dropped, thus foods and energy begin going upwards again.

___

All market commentary and analysis: https://chiasmusmagazine.blogspot.com/search/label/markets

Comments

Post a Comment