NASDAQ IS BID, ALTHOUGH SUPPRESSED BY HIGH OIL AND YIELDS AND SQUEEZED INTO A TIGHT TRADING RANGE. CAN IT BREAKOUT OR SELL OFF? WE SHALL SEE. (Part 1)

Chart 1

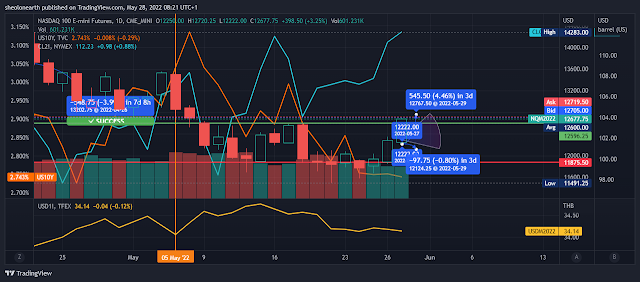

The NASDAQ blew apart short positions (Chart1), with the market scrambling to buy in, while the 10 YR yield begins its collapse, rising to 3% on 6th May and now falling towards 2% (March 2022). Is it possible that the Federal Reserve has stop raising rates? Is the market misreading and underplaying inflation? While resorting to a tentative reflation trade? On the hopes that the U.S will miss a recession and that inflation is now falling.

Note long and short positions as a hedge.

Tricky assumptions, when there is still trillions waiting on the sidelines to buy back in, but of course this is more of greed trade than not. The Fed knows inflation is out of control, so I doubt they will hold pat on at least driving the interest rate to 2%

However as clear as day, the oil price isn't coming anytime soon. (Chart 2) . Closing at $111 (WTI), also refer to the pane beneath the WTI, showing food inflation remaining at a four year high,

Rather than an all in reflation trade, this seems like the beginning of volatility.

___

Be careful.

Comments

Post a Comment