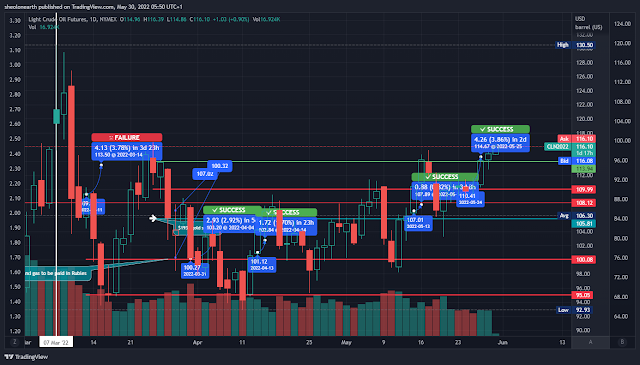

Oil breaks through $113 resistance, now bid over $115: two day forecast correct. China slowly emerging from COVID lockdowns, the Ukraine war wages on as Russia begins to use Wheat/Natural gas as a leverage play against Western sanctions, leading to higher electricity and food prices.

I caught the oil price swing from $110 to $114, up 3.86% with in 2 days. Oil is now bid at $115. Note Chart 1 above, this occurred with market assuming that the Federal Reserve will sit tight on interest rates and groans from Western countries on slowing global economic growth via China's COVID lockdowns, which are slowly lifting. The U.S Dollar sold off. Yet, even with apparent global demand abating, the oil price remained above $100 as the Ukraine war begins to fade from headlines. Stagflation is notoriously hard for markets to read, particularly when it has been underwritten for so long, what might be slowing down in economic outlooks, are inflating elsewhere else. And since there is always a poorly handed spring back to consumption after quarantines (China), get ready for a spike in the oil price, food and supply crunches across the board.

Chart 2, is indictive to why Russia's invasion of Ukraine will effect us all. From the top: Natural gas futures are trading at a five year high, bid at $686. Yellow line is electricity use in the U.S, which traditionally trails the Nat gas price, explained in this post, electricity production relies on over 38% of natural gas to power the electrical grid.

The chart below/s are U.S wheat supplies (purple line), the horizontal red line (same chart) represents the 5 year decline in stockpiles. Pane beneath are wheat futures, which spiked on the 20th/21st February 2022 when Russia invaded Ukraine (vertical light blue horizontal line). Which in turn dragged up the Nat Gas price and electricity costs/use.

Comments

Post a Comment