TESLA is amidst a price collapse, dropping 12% month-over-month. Short positions are on but cautious as 'short interest' begins to pick up. Climbing bond yields and a high U.S. Dollar will keep Tesla as a sell. Side note: Crypto crash could destabilize the NASDAQ.

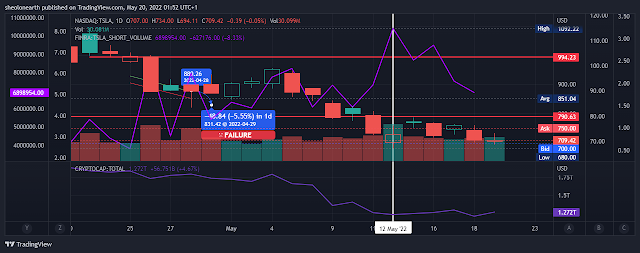

(Chart 3)

Is Tesla heading for a price collapse? All indications are that it is, as a chaos storm has hit the electrical car company from all sides. From the CEO Elon Musk, going all in on his Twitter acquisition and losing the plot with the whole thing, all my financial posts here, to the Shanghai/China lockdown/s that have squeezed Tesla, delaying next models components for the electrical car market, hence supply chain crunches will increase prices for the consumer. Will people be able to afford the newer models of Tesla? Inflation is brutal for companies as they try and forecast forward profits and if supply chain costs also hamper the profit margins, chances are Tesla will fall very short of q2 profit expectations. Everything will be revised down, which means the share price takes the immediate hit. As noted with the Tesla Chart 1 above, it already has begun.

Chart 2 and 3: April short positions took a hit in April 2022 28th at $877 with 870 drop position was at 833, Tesla rallied to 952 04 May 2022 as short interest (purple line) picked up, slamming the price down to 873, 12th May 2022 short interest and volume spiked (vertical line), Tesla was sold to 728 with short positions and selling pressure maintained to the 19th May 2022 bids at $700 per share.

Bonus chart below, separate pane, is Crypto currency Market cap is at 1.27 Trillion, which is amidst, as you can see from the Chart a price wipeout as traders and holders of the E-Coins deleverage and cover margin loans/calls. Central Banks probably don't care if E-Coins return to fair value, what ever that is, but any major crash in the Crypto market could destabilize financial markets en masse.

Say, if someone with swing sells a block trade from hell.

___

Trade with care.

Comments

Post a Comment