Chiasmus magazine blog. 2023 a year in review: What inflation fight? Easy money and cheap credit were pouring into the market in 2023. So much for tight liquidity to bring down inflation.

Did the 2023 inflation fight luck out? Or did the Federal Reserve contribute, all considering, in their very benign effort in tightening liquidity for 2023. When in fact the opposite happened, money was pouring in from all directions. And debt/credit rates in the U.S. barely moved upward. As noted in my January 31st 2023 post, the Fed gave very clear indication to the market at the start of 2023, that it was going to be light on in their inflation fight. Hence the market was pretty much bid throughout the whole year. A rule of thumb when we do have a high U.S. dollar and interest rates rates higher than 6%, it usually crimps speculation.

___

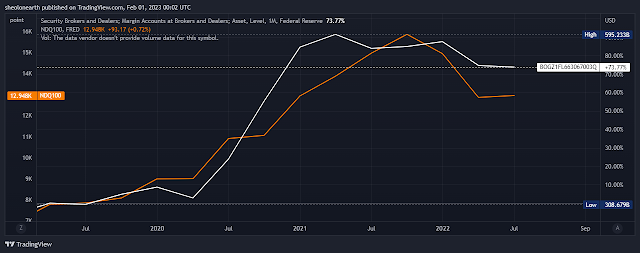

SPECULATION RETURNS TO THE NASDAQ IN EXPECTATION THAT CENTRAL BANKS MORE SO THE FED WILL BEGIN TO SLOW AND PAUSE RATE HIKES. THE MILD NORTHERN HEMISPHERE WINTER IS THE REASON FOR ENERGY INFLATION FALLING, YET THE DROUGHT IN SOUTH AMERICA IS PAINTING A PICTURE OF 2022 INFLATION REDUX.

The market continues to price out any stagflation/inflation fears and price in a redux of speculation, ala economic slowdown via Central Banks pausing or even its absurdity, cutting rates. As mentioned in previous posts this would save the massive amounts of margin loans and leverage needed to bid up the NASDAQ, in which rates as one would expect, would cut positions dramatically. Pleaser refer to Chart 1, showing brokerage margin account/s overlaid with the NASDAQ, which are both steady in expectations of a slow down in rate hikes by the Federal Reserve.

Luck was indeed on the side of monetary policy in the fight against inflation, as the mild winter for the Northern Hemisphere had ensured that the stockpiles of natural gas, not so much crude, have caused the price to collapse over 30% since its December 2022 highs. But financial luck has a flip side, particularly when climate change is rewriting the narrative, as the drought in South America is beginning to take hold driving up the price of Soy over 13% since December 2022. Yet, it is the futures price of Coffee a bellwether for inflation; which has spiked from January 2023 lows to its current 17% price rise. Please refer to Chart 2.

Comments

Post a Comment