The Reserve Bank of Australia has lifted rates to 2.85% still below the yield expectations of the short end of the Aust bond market at over 3.50%. The Australian dollar sold off on the decision, lifting the oil price to two month high/s.

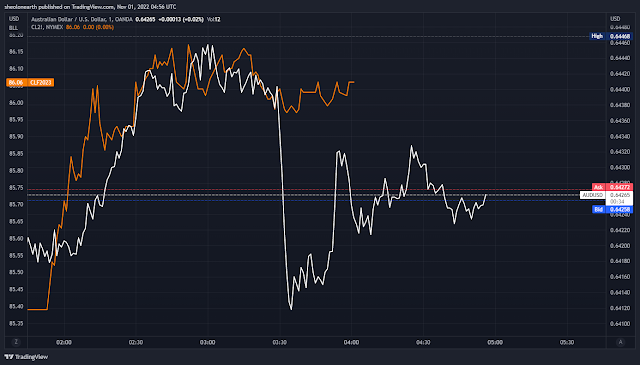

The Reserve Bank of Australia increased interest rates by 25 basis points bringing the cash rate of 2.85%, this was an expected rate increase, which was not essentially priced in by the market, but rather meeting expectations of commercial banks. Therefor the Australia Dollar sold off within moments of the rate decision, please refer to Chart 1. As the RBA sticks to their dovish take on inflation in Australia which could be a calling card for other Central Banks to ease off implementing higher interest rates. So for good measure I have overlaid the oil price and the AUD, as you can see the oil price went bid on the decision. If converting the oil price to AUD (price of oil at $86 divided by AUD 0.64) would be = $134 a barrel.

The issue is not the slowness of lifting rates, but rather sitting on small rate increase/s and hypothetically even if the RBA is attempting to reach the terminal rate increase of between 4% and 4.25% (refer to horizontal lines Chart 2), it is trailing way behind the yield expectations of the 10 YR bond at 3.77%, then we do indeed have an issue of a currency (AUD) that could be in a state of collapse (Chart 3). And inflation in Australia will continue to surge (pale green line) lead by energy inflation.

The RBA has not intervened into the Foreign Exchange market as such like Bank of Japan and Bank of England have recently done in selling U.S. Dollars, but has been known to implement yield control as it did within the 2020 pandemic and global bond rout. The warning that the market is giving is that any major yield and U.S. Dollar declines will further imbed inflation globally. And so far, what I have seen with the attempt at suppressing inflation by Central Banks has very tentative in their approaches.

Comments

Post a Comment